Real-time Market Analysis with Online Learning

Welcome to our cutting-edge project where the worlds of deep learning and finance intersect! In this endeavor, we’re using online learning to make real-time predictions of market exchange rates. The heart of our system is the SGDRegressor model, known for its efficiency in dealing with data that’s constantly changing and growing, perfect for the dynamic world of financial markets.

Completion Date: June 2023 | Tools: ML, Sklearn, Flask | URL: https://www.statsmetrics.ng/

Introduction

The financial world is characterized by ever-changing market dynamics. Predicting market exchange rates in real-time is a challenging yet essential task for investors, traders, and financial institutions. This project leverages online learning, particularly the SGDRegressor model, to make real-time predictions of market exchange rates, bridging the gap between finance and technology.

The Challenge

- Volatile Markets: Financial markets are known for their volatility, with exchange rates changing frequently due to various global factors.

- Need for Real-time Predictions: In the high-speed world of finance, even a delay of a few seconds can lead to significant losses. Real-time predictions are vital.

- Continuous Adaptation to New Data: Traditional machine learning models may not adapt quickly enough to new data, limiting their predictive accuracy over time.

- Accessibility and Usability: Making these predictions accessible to a broad audience, including individual investors and businesses, is essential for maximum impact.

What We Did to Solve the Challenge

- Deployed SGDRegressor: We used the Stochastic Gradient Descent Regressor (SGDRegressor), a model well-suited for online learning, allowing it to adapt to new data points as they become available.

- Integrated Real-time Data Feeds: We incorporated real-time financial data feeds into the model, ensuring that the latest market information is always considered.

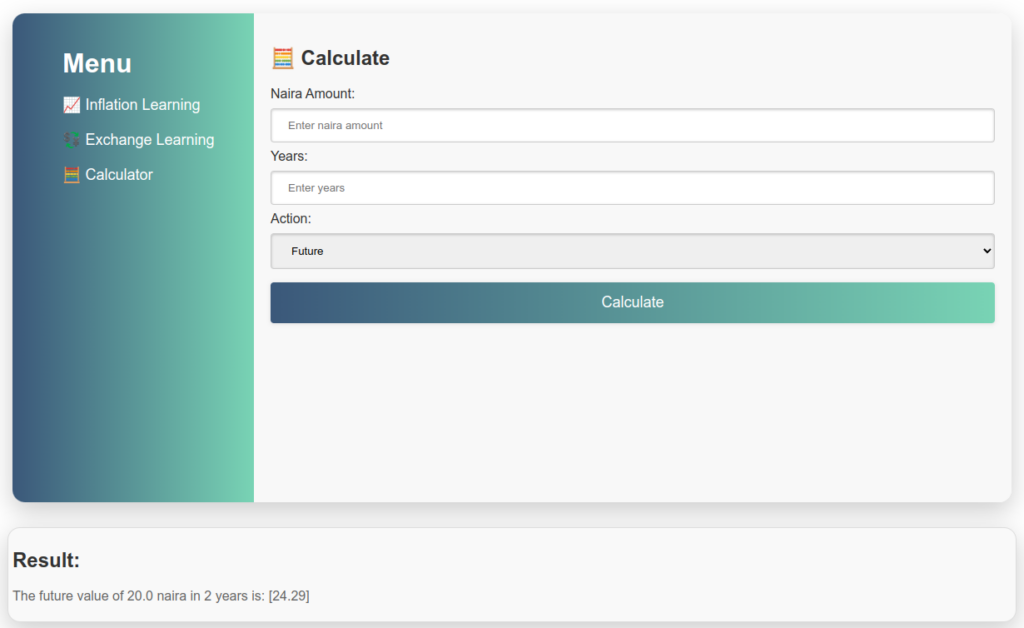

- Developed a Flask Web Application: To make the predictions accessible, we developed a Flask-based web application, providing an intuitive interface for users to view and analyze predictions.

- Ensured Continuous Learning: The model was designed to continuously learn from new data, allowing it to adapt to market changes, and stay relevant over time.

Impact and Conclusion

- Empowering Investors and Traders: By providing real-time predictions, the project assists investors, traders, and businesses in making timely and informed decisions.

- Democratizing Financial Analysis: By offering a user-friendly web interface, the project makes complex financial predictions accessible to individuals without deep financial expertise.

- Enhancing Strategic Decision-making: For corporations and financial institutions, real-time market analysis can inform strategic decisions, such as hedging strategies and investment allocations.

- Contribution to Financial Technology (FinTech): This project adds to the burgeoning field of FinTech, illustrating how AI and machine learning can transform traditional financial services.

- Potential for Broader Applications: The principles of online learning used here can be applied to various other domains that require real-time data analysis and prediction.

The seamless fusion of online learning, real-time market data, and user-friendly application design in this project symbolizes the modernization of financial services through technology. As we navigate the complex waters of global finance, AI-powered solutions like this one offer a beacon of clarity and insight. It’s not just about making better financial decisions; it’s about creating a smarter, more responsive, and more accessible financial world for everyone.